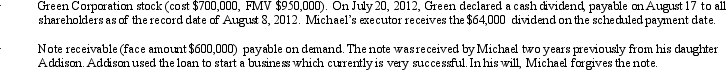

At the time of his death on August 7,2012,Michael owned the following assets.

How much,as to these transactions,is included in Michael's gross estate?

How much,as to these transactions,is included in Michael's gross estate?

Definitions:

Variable Selling Costs

Expenses that change in proportion to the volume of sales, such as commissions and shipping costs.

Sales Forecasts

Projections of future sales revenue, based on market analysis, historical data, and other estimations.

Actual Costs

The real costs incurred in the production of goods or services, including all direct and indirect expenses.

Inefficient Divisions

Parts of an organization that operate with lower productivity or effectiveness compared to expected standards.

Q4: Helene Corporation owns manufacturing facilities in States

Q62: The taxpayer should use ASC 740-30 (APB

Q64: Tomas owns a sole proprietorship,and Lucy is

Q81: Most states begin the computation of taxable

Q85: The general statute of limitations regarding Federal

Q85: In valuing a life insurance policy that

Q106: Norman Corporation owns and operates two manufacturing

Q140: If personal property is leased with real

Q146: In his will,Hernando provides for $50,000 to

Q151: Which of the following statements is incorrect