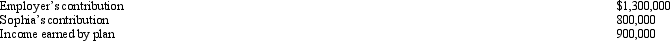

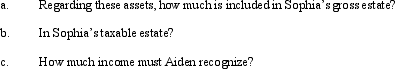

At the time of her death in 2012,Sophia was a participant in her employer's qualified pension plan.Her accrued balance in the plan is:

Sophia also was covered by her employer's group term life insurance program.Her policy (maturity value of $100,000)is made payable to Aiden (Sophia's husband).Aiden is also the designated beneficiary of the pension plan.

Sophia also was covered by her employer's group term life insurance program.Her policy (maturity value of $100,000)is made payable to Aiden (Sophia's husband).Aiden is also the designated beneficiary of the pension plan.

Definitions:

LIFO

An inventory valuation approach called Last In, First Out dictates that the newest items in inventory are the first to be accounted for as sold or used.

Cost of Goods Sold

Cost of Goods Sold represents the direct costs attributable to the production of the goods sold by a company, including material, labor, and overhead costs.

Lower-of-Cost

An accounting principle that states inventory is to be recorded at the purchase cost or the market value, whichever is lower.

Market Valuation

The estimated value or worth of an asset or a company determined through various methods, including market prices and financial modeling.

Q12: During the current year,Quartz Corporation (a calendar

Q30: The valuation allowance can reduce either a

Q47: The § 2513 election to split gifts

Q66: Entity accounting income is controlled by the

Q73: Which of the following statements regarding the

Q80: Does the tax preparer enjoy an "attorney-client

Q84: CPA Jennifer has heard about the AICPA's

Q122: A negligence penalty is assessed when the

Q130: The tax professional can do more than

Q151: Which of the following statements is incorrect