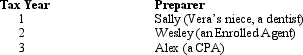

Vera is audited by the IRS for three tax years.Her returns were prepared by the following parties,to each of whom Vera paid a professional fee.  Vera wants help in appearing before the IRS Revenue Agent for the audit.Which of the following statements is correct?

Vera wants help in appearing before the IRS Revenue Agent for the audit.Which of the following statements is correct?

Definitions:

Credit Purchase

The acquisition of goods or services with an agreement to pay later, usually within an agreed period.

Recorded

The act of entering financial transactions into the accounting records of a business.

Bill Paid

An event where an obligation, often recorded as an accounts payable, is settled by paying the outstanding amount.

Accounts Receivable

Customer indebtedness to a company for the provision of goods or services that remain unpaid.

Q10: Francis is the CEO of Give,Inc. ,a

Q11: Art makes a gift of stock in

Q20: State and local politicians tend to apply

Q37: Which of the following statements does not

Q51: Woeful,Inc. ,a tax-exempt organization,leases a building and

Q54: In planning for the use of §

Q91: In connection with a traditional IRA that

Q99: The typical local property tax falls on

Q122: Bob and Paige are married and live

Q126: Currently,the IRS charges a _% interest rate