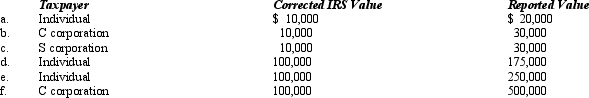

Compute the overvaluation penalty for each of the following independent cases involving the taxpayer's reporting of the fair market value of charitable contribution property.In each case,assume a marginal income tax rate of 35%.

Definitions:

Rental Apartments

Housing units that are leased to tenants for a set period of time as defined in a rental agreement.

Inverse Demand Function

A mathematical representation showing how the price of an item needs to adjust to achieve a certain level of demand; it's the reverse of the demand function.

Inverse Supply

The inverse supply curve represents the relationship between the price of a good and the quantity supplied, plotted with price on the vertical axis and quantity on the horizontal.

Inverse Demand Function

A mathematical function that expresses the price of a good as a function of the quantity demanded.

Q15: Before his nephew (Dean)leaves for college,Will loans

Q31: Eric dies at age 96 and is

Q55: The AICPA's Statements on Standards for Tax

Q74: The tax preparer penalty for taking an

Q98: An exempt organization that otherwise would be

Q103: Which of the following independent statements correctly

Q103: Lime,Inc. ,has taxable income of $334,000.If Lime

Q106: Which of the following is not a

Q108: At the time of her death on

Q112: Hambone Corporation is subject to the State