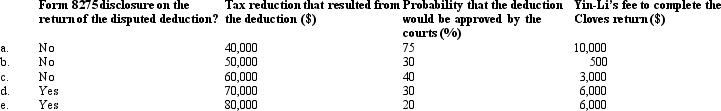

Yin-Li is the preparer of the Form 1120 for Cloves Corporation.On the return,Cloves claimed a deduction that the IRS later disallowed on audit.Compute the tax preparer penalty that could be assessed against Yin-Li in each of the following independent situations.

Definitions:

Pupil

The opening in the center of the iris of the eye that allows light to enter the retina.

Special Senses

The senses including vision, hearing, taste, smell, and equilibrium, which have specialized organs devoted to them.

Complex Sensory Organs

Organs specialized for the perception of stimuli such as sight, hearing, balance, taste, and smell, integrating multiple structural and functional components.

Optic Disc

The point of exit for ganglion cell axons leaving the eye, where the optic nerve begins, and notably lacks photoreceptor cells, creating a "blind spot."

Q14: C corporations and S corporations can generate

Q30: A CPA can take a tax return

Q43: Simpkin Corporation owns manufacturing facilities in States

Q55: If a traditional IRA is subject to

Q60: Parent and Junior form a non-unitary group

Q69: Rick and Gail are equal tenants in

Q75: The excise tax imposed on a private

Q78: Each of the following can pass profits

Q88: After a tax audit,the taxpayer receives the

Q113: Which of the following requirements must be