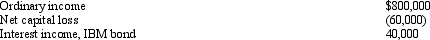

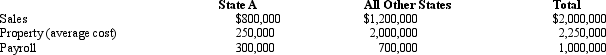

You are completing the State A income tax return for Quaint Company,LLC.Quaint operates in various states,showing the following results.

In A,all interest is treated as business income.A uses a sales-only apportionment factor.Compute Quaint's A taxable income.

In A,all interest is treated as business income.A uses a sales-only apportionment factor.Compute Quaint's A taxable income.

Definitions:

Interest Rate

The portion of a loan assessed as interest to the borrower, typically described as an annual rate of the loan's remaining balance.

Payment

The transfer of money, goods, or services in exchange for a product, service, or to fulfill an obligation.

Annual Interest Rate

The percentage of a sum of money charged for its use per year.

Double

To increase or become twice as much in size, amount, or number.

Q20: Schedule UTP of the Form 1120 reconciles

Q42: Mandy Corporation realized $1,000,000 taxable income from

Q46: Faye,a CPA,is preparing Judith's tax return.Before computing

Q61: An S corporation is not subject to

Q71: List some techniques which can be used

Q73: Roger owns 40% of the stock of

Q82: Which of the following is one of

Q94: Which,if any,of the following items has no

Q103: Concerning a taxpayer's requirement to make quarterly

Q143: Which item does not appear on Schedule