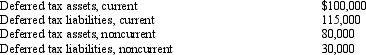

After applying the balance sheet method to determine the GAAP income tax expense of Cutter Inc. ,the following account balances are found.Determine the balance sheet presentation of these amounts.Hint: Which of the accounts should you combine for the final balance sheet disclosure?

Definitions:

Non-profit Organization

An entity structured to operate and provide services or support for public or social benefit rather than generating profits for owners or shareholders.

Triple Bottom Line

A sustainability framework that evaluates a company's performance based on three pillars: social, environmental, and financial factors.

CSR Activities

Corporate Social Responsibility actions undertaken by companies to positively impact society, the environment, and their communities.

Internal Attributions

The process of explaining behavior as being caused by internal characteristics of the individual rather than external factors.

Q1: A _ tax is designed to complement

Q38: Blue,Inc. ,has taxable income before salary payments

Q47: The partnership reports each partner's share of

Q55: Matt receives a proportionate nonliquidating distribution.At the

Q73: Roger owns 40% of the stock of

Q77: An S corporation with substantial AEP has

Q78: A partnership must provide any information to

Q87: A C corporation offers greater flexibility in

Q95: In conducting multistate tax planning,the taxpayer should:<br>A)Review

Q135: A(n)_ should be requested when the taxpayer