Essay

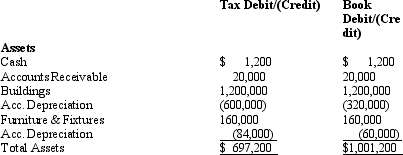

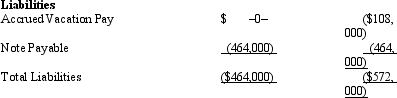

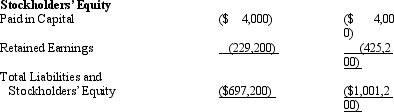

Amelia,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

Definitions:

Related Questions

Q2: Yahr,Inc. ,is a domestic corporation with no

Q8: The _ tax levied by a state

Q11: How does an auditor determine whether a

Q57: Judy,a regional sales manager,has her office in

Q71: For Federal income tax purposes,a distribution from

Q82: To which of the following entities does

Q107: Last year,Ned's property tax deduction on his

Q127: Henrietta has hired Gracie,a CPA,to complete this

Q139: The general objective of the tax on

Q149: The _,a presidential appointee,is the "IRS's attorney."