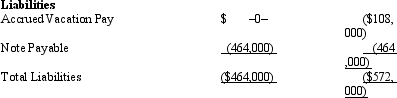

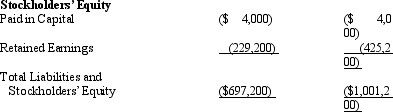

Amelia,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

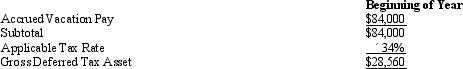

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Definitions:

Gender-inappropriate Behavior

Actions or behaviors that do not conform to societal norms or expectations for a person's assigned gender.

Gender-schema Theory

A theory suggesting that individuals learn about gender roles and cultural expectations mainly through societal influences, impacting their perceptions and behaviors.

Sociocultural Standards

Sociocultural standards denote the norms, values, and expectations prescribed by a society or cultural group, influencing individual behavior and social interactions.

Internal Motivation

The drive to act or accomplish tasks based on personal satisfaction and intrinsic rewards rather than external incentives.

Q11: How does an auditor determine whether a

Q35: Plus,Inc. ,is a § 501(c)(3)organization.It generates a

Q39: Mike contributed property to the MDB Partnership

Q69: The Commissioner of the IRS is appointed

Q76: Identify a disadvantage of being an S

Q95: Discuss benefits for which an exempt organization

Q101: The Dispensary is a pharmacy that is

Q102: A typical state taxable income addition modification

Q103: Typically,corporate income taxes constitute about 20 percent

Q151: Which of the following statements is incorrect