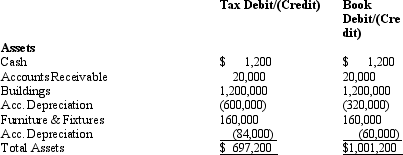

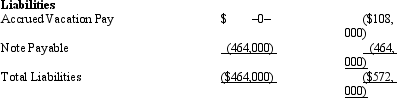

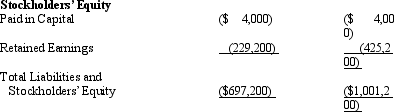

Amelia,Inc. ,is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

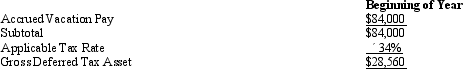

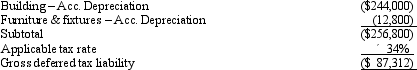

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Amelia,Inc.'s,gross deferred tax assets and liabilities at the beginning of Amelia's year are listed below.

Definitions:

Going-Concern Assumption

An accounting principle assuming that a company will continue to operate indefinitely and not go bankrupt, impacting financial decisions and reporting.

Full Disclosure

The principle that requires a company to provide all necessary information in its financial statements to ensure they are complete and accurate.

Historical Cost

The original monetary value of an asset or investment, without adjusting for inflation or appreciation over time.

Revenue Recognition

The accounting principle that determines the specific conditions under which income becomes realized as revenue.

Q1: If an S corporation has C corporate

Q15: A property distribution from a partnership to

Q28: Techniques that can be used to minimize

Q29: Nicole's basis in her partnership interest was

Q73: A state might levy a(n)_ tax when

Q88: To the extent of built-in gain or

Q92: Beginning in 2012,Ewing,Inc. ,an S corporation,holds a

Q103: Concerning a taxpayer's requirement to make quarterly

Q107: Last year,Ned's property tax deduction on his

Q127: If the IRS reclassifies debt as equity