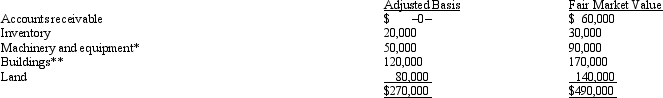

Albert's sole proprietorship owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Albert sells his sole proprietorship for $500,000.Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Definitions:

Stereotype

A widely held but fixed and oversimplified image or idea of a particular type of person or thing.

Persuasive Definitions

Definitions that aim to sway opinion or affect attitudes by the way terms are described.

Critical Thinking

A set of abilities we utilize daily, essential for our complete mental and personal growth.

Barrier

An obstacle that prevents movement or access, or hinders progress towards a goal.

Q16: Appeals from the Court of Federal Claims

Q22: Kim Corporation,a calendar year taxpayer,has manufacturing facilities

Q45: Subchapter C refers to the "Corporate Distributions

Q51: The MOG Partnership reports ordinary income of

Q64: A limited liability company (LLC)is a hybrid

Q68: Amelia,Inc. ,is a domestic corporation with the

Q73: What was Cleary's capital account balance at

Q80: Brittany,Jennifer,and Daniel are equal partners in the

Q81: Unrelated debt-financed income,net of the unrelated debt-financed

Q95: Under what circumstances,if any,do the § 469