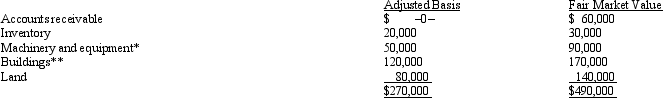

Mr.and Ms.Smith's partnership owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Mr) and Ms.Smith each have a basis for their partnership interest of $135,000.Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Definitions:

Amistad

Ship that transported slaves from one port in Cuba to another, seized by the slaves in 1839. They made their way northward to the United States, where the status of the slaves became the subject of a celebrated court case; eventually, most were able to return to Africa.

International Ban

A prohibition or restriction placed by international bodies or agreements on specific activities, goods, or countries, typically to enforce international law or policy.

Escaping To Freedom

Often refers to the act of enslaved individuals fleeing from bondage to attain freedom, especially during the era of slavery in the United States.

Maryland

A state located in the Mid-Atlantic region of the United States, known for its significant historical sites and as the birthplace of the national anthem.

Q2: A per-day,per-share allocation of flow-through S corporation

Q16: Hannah sells her 25% interest in the

Q21: An S corporation reports a recognized built-in

Q31: Compute Quail Corporation's State Q taxable income

Q39: The _ tax usually is applied at

Q50: Under P.L.86-272,which of the following transactions by

Q56: Federal tax legislation generally originates in the

Q59: An S corporation can be a shareholder

Q94: Which of the following statements is incorrect?<br>A)No

Q121: Identify some state/local income tax issues facing