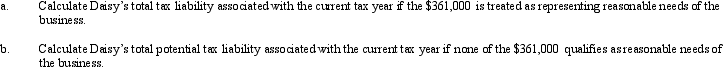

Daisy,Inc. ,has taxable income of $850,000 during 2012,its first year of operations.Daisy distributes dividends of $200,000 to its 10 shareholders (i.e. ,$20,000 each).Daisy earmarks $361,000 of its earnings for potential future expansion into other cities.

Definitions:

Debt Investments

Investments made by purchasing debt instruments, such as bonds, where the investor becomes a creditor to the issuer.

Journal Entries

Recorded transactions in the accounting journal that show the financial activities of a company.

Marketable

Describes assets or securities that can easily be sold or converted into cash without a significant loss in value.

Cash Dividend

A payout from the company's profits, determined by the board of directors, given to certain shareholders as cash.

Q2: Yahr,Inc. ,is a domestic corporation with no

Q7: What was the balance in Thurman's Capital

Q17: Robin Company has $100,000 of income before

Q41: An ad valorem property tax is based

Q56: One of the requirements for an exempt

Q58: During the current year,MAC Partnership reported the

Q61: An S corporation is not subject to

Q78: Sales/use tax nexus is established for the

Q108: State Q has adopted sales-factor-only apportionment for

Q127: If the IRS reclassifies debt as equity