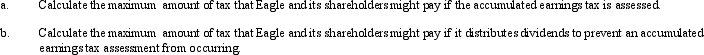

Eagle,Inc.recognizes that it may have an accumulated earnings tax problem.According to its calculation,Eagle anticipates it has accumulated taxable income,before reduction for dividends paid,of $600,000 in 2012.Assume that its shareholders are in the 35% marginal tax bracket.

Definitions:

Mental Illness

Mental illness refers to a wide range of mental health conditions that affect a person's thinking, feeling, behavior, or mood, potentially impacting their ability to function day-to-day.

No-fault Divorce

A legal process whereby a marriage can be dissolved without needing to establish wrongdoing by either party.

Divorce Law

The body of law dealing with the dissolution of marriage, including the division of assets, custody of children, and alimony.

Psychological Well-being

A state of mental health characterized by positive feelings, low levels of distress, and a satisfying sense of personal fulfillment and growth.

Q3: S corporations flow-through income amounts to its

Q8: Exempt organizations which are appropriately classified as

Q26: Samuel is the managing general partner of

Q37: The American Opportunity scholarship credit can be

Q43: Pelican,Inc. ,a C corporation,distributes $275,000 to its

Q47: The advantages of the partnership form of

Q92: Beginning in 2012,Ewing,Inc. ,an S corporation,holds a

Q97: Watch,Inc. ,a § 501(c)(3)exempt organization,solicits contributions through

Q103: Typically,corporate income taxes constitute about 20 percent

Q134: Trolette contributes property with an adjusted basis