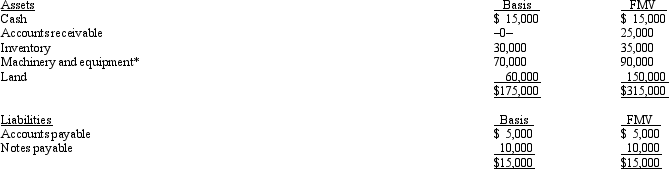

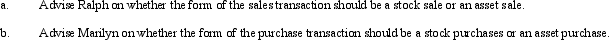

Ralph owns all the stock of Silver,Inc. ,a C corporation for which his adjusted basis is $225,000.Ralph founded Silver 12 years ago.The assets and liabilities of Silver are as follows:

*Accumulated depreciation of $55,000 has been deducted.

*Accumulated depreciation of $55,000 has been deducted.

Ralph and the purchaser,Marilyn,have agreed to a purchase price of $350,000 less any outstanding liabilities.They are both in the 35% tax bracket,and Silver is in the 34% tax bracket.

Definitions:

Transitional Expression

A word or phrase that connects ideas and guides the reader from one thought to another in a piece of writing.

Stringed Instruments

Musical instruments that produce sound through the vibration of strings, such as violins, guitars, and cellos.

Percussion Instruments

Musical instruments that produce sound primarily by being struck, shaken, or scraped, such as drums, cymbals, and maracas.

Percussion Instruments

Musical instruments that produce sound by being struck, shaken, or scraped, such as drums or cymbals.

Q5: Distributions of which assets during an S

Q11: Most states waive the collection of sales

Q13: A partnership cannot use the cash method

Q33: Jogg,Inc. ,earns book net income before tax

Q35: The accumulated earnings tax rate in 2012

Q52: Normally a distribution of property from a

Q56: Martin contributes property with an adjusted basis

Q79: A qualifying S election requires the consent

Q89: Realized gain is recognized by an S

Q99: The typical local property tax falls on