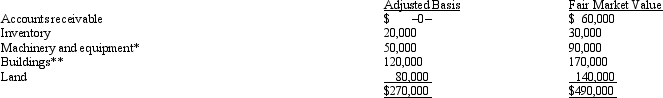

Albert's sole proprietorship owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Albert sells his sole proprietorship for $500,000.Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

Definitions:

Client-Visits

The instances when a service provider meets with their clients, either in person or virtually, for consultation or service delivery.

Planning Budget

A financial plan that estimates the revenue and expenses for an organization over a specific period, taking into account projected operations and initiatives.

Net Operating Income

A measure of a company's profitability from its regular business operations, excluding deductions for interest and taxes.

Planning Budget

A financial plan that estimates the revenue and expenses for a particular period, often used for future financial planning.

Q18: What was Wasser's capital balance at the

Q34: The LMO Partnership distributed $30,000 cash to

Q60: The Section 179 expense deduction is a

Q62: All tax preference items flow through the

Q76: Which of the following is an election

Q96: Cassandra is a 10% limited partner in

Q109: Hermann Corporation is based in State A

Q114: Politicians frequently use tax credits and exemptions

Q129: A taxpayer has nexus with a state

Q136: An effective way for all C corporations