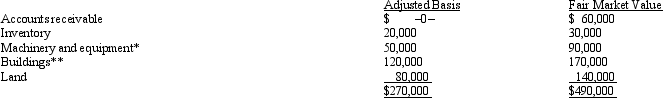

Mr.and Ms.Smith's partnership owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Mr) and Ms.Smith each have a basis for their partnership interest of $135,000.Calculate their combined recognized gain or loss and classify it as capital or ordinary if they sell their partnership interests for $500,000.

Definitions:

Dendrite

The branched projections of a neuron that act to conduct the electrochemical stimulation received from other neural cells to the body, or soma, of the neuron from which the dendrites project.

Neuron

A unique cell that carries nerve signals, referred to as a nerve cell.

Occipital

Pertaining to the occipital lobe in the brain, located at the back, primarily responsible for visual processing.

Primary Visual Cortex

A region in the occipital lobe of the brain responsible for processing visual information from the eyes.

Q14: Roughly five percent of all taxes paid

Q16: An S corporation's LIFO recapture amount equals

Q30: Blaine contributes property valued at $50,000 (basis

Q79: A(n)_ member is required to follow the

Q81: Loss will be recognized on any distribution

Q82: Typically included in the sales/use tax base

Q101: Which of the following are "reasonable needs"

Q105: The § 469 passive activity loss rules

Q133: Claude Bergeron sold 1,000 shares of Ditta,Inc.

Q149: Most IRAs can own stock in an