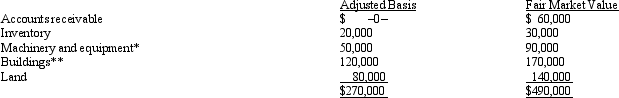

Kristine owns all of the stock of a C corporation which owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Her adjusted basis for her stock is $270,000.Calculate Kristine's recognized gain or loss and classify it as capital or ordinary if she sells her stock for $500,000.

Definitions:

Lessor's Tax Rate

The tax rate applicable to a lessor, the entity that leases out a property or asset, on the income generated from the lease.

Borrowing Increases

The act of increasing the amount of money borrowed, which typically leads to higher debt levels and potentially increased interest expenses.

Purchase Price

The amount paid to buy a good, service, or financial asset.

Off-Balance Sheet Lease Financing

Off-balance sheet lease financing involves leasing arrangements that are not recorded on a company's balance sheet, potentially making a company's financial condition appear stronger than it actually is.

Q11: Most states waive the collection of sales

Q30: The valuation allowance can reduce either a

Q32: Compost Corporation has finished its computation of

Q34: Which of the following are consequences of

Q77: An S corporation with substantial AEP has

Q77: In which of the following independent situations

Q83: The § 1374 tax is a corporate-level

Q99: On January 1,Bobby and Alice own equally

Q108: State Q has adopted sales-factor-only apportionment for

Q127: An S shareholder's basis is increased by