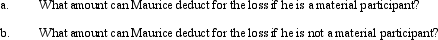

Maurice purchases a bakery from Philip for $410,000.He spends an additional $150,000 (financed with a nonrecourse loan)updating the bakery equipment.During the first year of operations as a sole proprietorship,the bakery incurs a loss of $125,000.Maurice has $300,000 of salary income as the chief financial officer of a publicly-traded corporation.He has interest income of $30,000 and dividend income of $50,000.

Definitions:

Merit Pay

Additional compensation provided to employees based on their job performance, highlighting the value of high performance and excellence.

Performance Appraisals

Formal assessments and reviews of an employee's work performance over a specific period, used to determine areas of improvement and inform decisions on promotions, bonuses, and training needs.

Organizations' Profits

The financial gain that an organization achieves after deducting the expenses, costs, and taxes necessary to sustain its operations.

Stock Price

The cost of purchasing a share of a company, which fluctuates based on market conditions, company performance, and investor perceptions.

Q7: What was the balance in Thurman's Capital

Q8: Anne contributes property to the TCA Partnership

Q9: Obtaining a deduction on payments made by

Q12: If an exempt organization is required to

Q27: Apportionment is a means by which a

Q41: Revenue generated by an exempt organization from

Q66: Shorter asset lives and accelerated methods increase

Q87: Which of the following would be currently

Q89: Realized gain is recognized by an S

Q135: In its first year of operations,a corporation