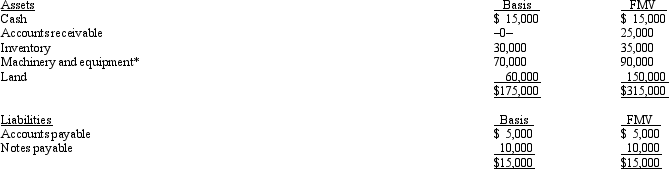

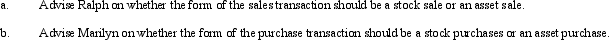

Ralph owns all the stock of Silver,Inc. ,a C corporation for which his adjusted basis is $225,000.Ralph founded Silver 12 years ago.The assets and liabilities of Silver are as follows:

*Accumulated depreciation of $55,000 has been deducted.

*Accumulated depreciation of $55,000 has been deducted.

Ralph and the purchaser,Marilyn,have agreed to a purchase price of $350,000 less any outstanding liabilities.They are both in the 35% tax bracket,and Silver is in the 34% tax bracket.

Definitions:

Probability Sample

In a probability sample, the units have a known and nonzero chance of being selected.

Representative Sample

A subset of a population that accurately reflects the members of the entire population.

Self-administered Questionnaires

Surveys or questionnaires that individuals complete on their own without interviewer guidance or interference.

Face-to-face Interviews

A method of quantitative or qualitative research where questions are asked directly to respondents in person, facilitating immediate and personalized responses.

Q11: Most states waive the collection of sales

Q24: Stephanie is a calendar year cash basis

Q24: A major,but not the sole,objective of the

Q48: Aubrey has been operating his business as

Q50: Radio,Inc. ,an exempt organization,trains disabled individuals to

Q98: Why are S corporations not subject to

Q106: Net operating losses incurred before an S

Q109: April is going to invest $200,000 in

Q115: Hopper Corporation's property holdings in State E

Q122: Which of the following is not correct