Multiple Choice

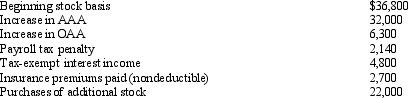

You are given the following facts about a 40% owner of an S corporation,and you are asked to prepare her ending stock basis.

Definitions:

Related Questions

Q1: Emma's basis in her BBDE LLC interest

Q9: Which of the following are exempt organizations

Q15: Tom and William are equal partners in

Q26: Determine the balance in both capital accounts

Q35: Plus,Inc. ,is a § 501(c)(3)organization.It generates a

Q39: Post-termination distributions that are charged against OAA

Q45: Which of the following statements regarding exempt

Q46: How can double taxation be avoided or

Q67: Which of the following sources has the

Q80: PaintCo Inc. ,a domestic corporation,owns 100% of