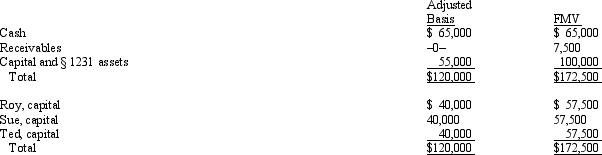

The December 31,2012,balance sheet of the RST General Partnership reads as follows.  The partners share equally in partnership capital,income,gain,loss,deduction and credit.Ted's adjusted basis for his partnership interest is $40,000.On December 31,2012,he retires from the partnership,receiving a $60,000 cash payment in liquidation of his interest.The partnership agreement states that $2,500 of the payment is for goodwill.Which of the following statements about this distribution is false?

The partners share equally in partnership capital,income,gain,loss,deduction and credit.Ted's adjusted basis for his partnership interest is $40,000.On December 31,2012,he retires from the partnership,receiving a $60,000 cash payment in liquidation of his interest.The partnership agreement states that $2,500 of the payment is for goodwill.Which of the following statements about this distribution is false?

Definitions:

Critical Value

A threshold in a statistical test that defines the boundary for deciding whether an observed statistic is extreme enough to reject the null hypothesis.

Alpha

A threshold value used in hypothesis testing to determine the significance level at which the null hypothesis is rejected in favor of the alternative hypothesis.

Non-directional Hypothesis

A hypothesis that does not predict the specific direction of the difference or relationship, only that one exists.

T-statistic

A statistic calculated from sample data used to assess the plausibility of the null hypothesis in t-tests.

Q7: Old Colonial Corp.(a U.S.company)made a sale

Q12: Jipsom and Klark were partners with capital

Q18: What was Wasser's capital balance at the

Q26: On January 1,2012,Zundel,Inc. ,an electing S corporation,has

Q31: When an S corporation liquidates,which of its

Q47: What happens when a U.S.company purchases goods

Q54: Primo Inc. ,a U.S.company,ordered parts costing 100,000

Q60: Walter wants to sell his wholly-owned C

Q86: Record the journal entry for the admission

Q88: What would Knight Co.report as consolidated basic