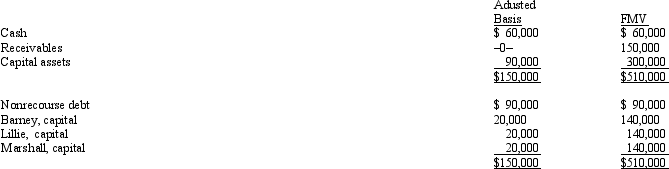

The BLM LLC's balance sheet on August 31 of the current year is as follows.  The nonrecourse debt is shared equally among the LLC members.On that date,Lillie sells her one-third interest to Robyn for $170,000,including cash and relief of Lillie's share of the nonrecourse debt.Lillie's outside basis for her interest in the LLC is $50,000,including her share of the LLC's debt.How much capital gain and/or ordinary income will Lillie recognize on the sale?

The nonrecourse debt is shared equally among the LLC members.On that date,Lillie sells her one-third interest to Robyn for $170,000,including cash and relief of Lillie's share of the nonrecourse debt.Lillie's outside basis for her interest in the LLC is $50,000,including her share of the LLC's debt.How much capital gain and/or ordinary income will Lillie recognize on the sale?

Definitions:

Height Control Valve

A valve in air suspension systems that maintains or adjusts vehicle height by regulating air pressure.

Unsprung Weight

The weight of the components of a vehicle that are not supported by the suspension system, affecting handling and comfort.

Adaptive Suspension

A suspension designed to adjust to load and road conditions. On trucks, this usually means an air suspension system. Adaptive suspensions can be either nonelectronic or electronically controlled. The term active suspension is also used.

Q5: Which one of the following is not

Q21: What was the balance in Young's Capital

Q26: Dan receives a proportionate nonliquidating distribution when

Q55: Only 80% of the shareholders must consent

Q60: The Section 179 expense deduction is a

Q63: Black,Inc. ,is a domestic corporation with the

Q64: What amount would have been reported for

Q73: Roger owns 40% of the stock of

Q87: Which of the following would be currently

Q92: Gladys contributes land with an adjusted basis