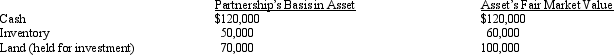

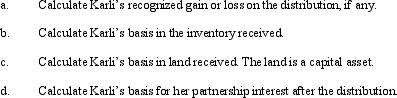

Karli owns a 25% capital and profits interest in the calendar-year KJDV Partnership.Her adjusted basis for her partnership interest on July 1 of the current year is $200,000.On that date,she receives a proportionate nonliquidating distribution of the following assets:

Definitions:

Larger Teams

Teams comprised of a significantly larger number of members, which can impact dynamics such as communication, coordination, and decision-making.

Skill-based Pay

A compensation system where an employee’s pay is based on the skills, capabilities, and knowledge they bring to a job, rather than the position they hold.

Job Skills

The expertise, abilities, and competencies that enable an individual to perform specific tasks and functions effectively in their professional role.

Training Costs

Expenses associated with developing skills and knowledge of employees or individuals through structured learning experiences.

Q19: Which trial court has 16 judges?<br>A)U.S.Tax Court.<br>B)U.S.Court

Q20: Explain the function of Temporary Regulations.

Q23: At the beginning of the year,Elsie's basis

Q26: Determine the balance in both capital accounts

Q34: An S corporation has a lesser degree

Q42: What was the balance in Thurman's Capital

Q46: Which state is a community property state?<br>A)North

Q77: Record the journal entry to record the

Q146: Blue Corporation elects S status effective for

Q154: An S corporation recognizes a _ on