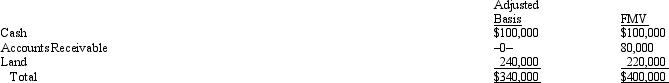

Hannah sells her 25% interest in the HIJK Partnership to Alyssa for $120,000 cash.At the end of the year prior to the sale,Hannah's basis in HIJK was $70,000.The partnership allocates $15,000 of income to Hannah for the portion of the year she was a partner.On the date of the sale,the partnership assets and the agreed fair market values were as follows.

Determine the amount and character of any gain that Hannah recognizes on the sale.

Determine the amount and character of any gain that Hannah recognizes on the sale.

Definitions:

Q1: What value is a tax citator to

Q9: A company has a discount on a

Q28: Form 1120S provides a shareholder's computation of

Q39: Anne retires and is paid $80,000 based

Q48: Aubrey has been operating his business as

Q55: How is the amount of excess acquisition-date

Q62: Where do dividends paid by a subsidiary

Q64: The major purpose of ASC 740 (SFAS

Q96: Ryan is the sole shareholder of Sweetwater

Q107: On January 1,2019,Cocker reacquired 8,000 of the