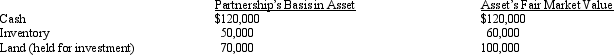

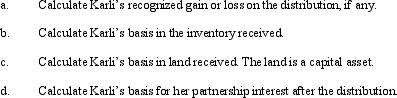

Karli owns a 25% capital and profits interest in the calendar-year KJDV Partnership.Her adjusted basis for her partnership interest on July 1 of the current year is $200,000.On that date,she receives a proportionate nonliquidating distribution of the following assets:

Definitions:

Flashback

The sudden and intense re-experiencing of past memories or traumatic events, often a symptom of PTSD.

Hypervigilance

An enhanced state of sensory sensitivity accompanied by an exaggerated intensity of behaviors aimed at detecting threats.

Systematic Desensitization

A behavioral therapy method for reducing fear and anxiety responses by gradually exposing the patient to the feared object or context in a controlled way.

Behavior Modification

The use of learned techniques to improve or change specific behaviors.

Q16: An S corporation's LIFO recapture amount equals

Q21: Martha receives a proportionate nonliquidating distribution when

Q25: If a corporation has no subsidiaries outside

Q41: Treasury Decisions are issued by the Treasury

Q52: What tax rates apply for the AMT

Q77: A gain will only arise on a

Q79: A qualifying S election requires the consent

Q83: What was the overall result of having

Q89: Julie and Kate form an equal partnership

Q94: Which,if any,of the following items has no