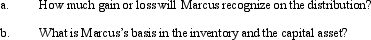

In a proportionate liquidating distribution in which the partnership is liquidated,Marcus received cash of $60,000,inventory (basis of $10,000,fair market value of $12,000),and a capital asset (basis and fair market value of $22,000).Immediately before the distribution,Marcus's basis in the partnership interest was $100,000.

Definitions:

Ischium

The curved bone forming the base of each half of the pelvis.

Delayed Healing

The slower than expected progress of wound healing, which may be influenced by factors like infection, poor nutrition, or underlying health conditions.

Slipped

Often used in medical contexts such as "slipped disc," referring to a condition where a spinal disc is displaced and presses on nerves.

Ice

Water frozen into a solid state, often used to cool beverages or reduce swelling in injuries.

Q6: The adoption tax credit can be explained

Q7: The ACE adjustment associated with the C

Q35: A spot rate may be defined as<br>A)The

Q44: C contributes $10,000 to the partnership and

Q46: Depletion in excess of basis in property

Q48: Which method is used for remeasuring a

Q55: Only 80% of the shareholders must consent

Q72: For a new corporation,a premature S election

Q74: ASC 740 (FIN 48)is the GAAP equivalent

Q95: The MOP Partnership is involved in leasing