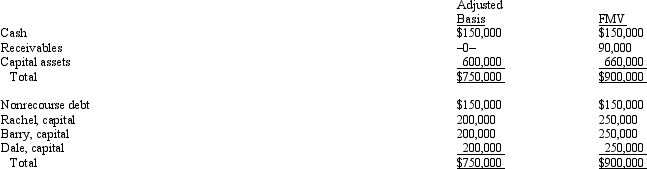

On August 31 of the current tax year,the balance sheet of the RBD General Partnership is as follows:

On that date,Rachel sells her one-third partnership interest to Lisa for $300,000,including cash and relief of Rachel's share of the nonrecourse debt.The nonrecourse debt is shared equally among the partners.Rachel's outside basis for her partnership interest is $250,000 (including her share of partnership debt).How much capital gain and/or ordinary income will Rachel recognize on the sale?

On that date,Rachel sells her one-third partnership interest to Lisa for $300,000,including cash and relief of Rachel's share of the nonrecourse debt.The nonrecourse debt is shared equally among the partners.Rachel's outside basis for her partnership interest is $250,000 (including her share of partnership debt).How much capital gain and/or ordinary income will Rachel recognize on the sale?

Definitions:

Budget Balancing

The process of adjusting government spending and revenue to ensure that the budget is not in deficit, aiming for a balanced budget.

Federal Budget

An itemized plan for the annual public expenditures of the United States, detailing government spending and revenue.

Paradox Of Thrift

The economic theory that personal savings can be detrimental to overall economic growth if too high, as they may reduce overall demand.

Great Recession

A severe global economic recession that occurred from late 2007 through mid-2009, characterized by widespread financial crisis, high unemployment, and significant drops in the economic activity.

Q2: Binita contributed property with a basis of

Q4: A taxpayer must pay any tax deficiency

Q10: Only one judge hears a trial in

Q35: An S corporation's separately stated items generally

Q39: Anne retires and is paid $80,000 based

Q52: S corporation status allows shareholders to realize

Q57: Jerry,a partner in the JSK partnership,begins the

Q72: For a new corporation,a premature S election

Q98: Tray Co.reported current earnings of $560,000 while

Q104: An S shareholder who dies during the