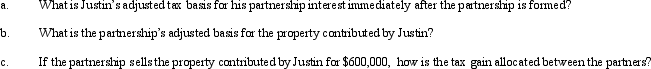

Greg and Justin are forming the GJ Partnership.Greg contributes $500,000 cash and Justin contributes nondepreciable property with an adjusted basis of $200,000 and a fair market value of $550,000.The property is subject to a $50,000 liability,which is also transferred into the partnership and is shared equally by the partners for basis purposes.Greg and Justin share in all partnership profits equally except for any precontribution gain,which must be allocated according to the statutory rules for built-in gain allocations.

Definitions:

Cash Received

The total amount of cash received by a company during a specific period from all its activities, including operations, investments, and financing.

Direct Method

In accounting, the direct method is a way of reporting cash flows from operating activities by listing major categories of gross cash receipts and payments.

Income Taxes Payable

The amount of federal, state, or local taxes that a company is obligated to pay to the tax authorities, based on its earnings, within the current accounting period.

Income Tax Expense

The cost incurred by businesses or individuals due to income taxes.

Q1: Michelle receives a proportionate liquidating distribution when

Q17: How much Foreign Exchange Gain or Loss

Q20: Under the current rate method,how would cost

Q27: Belsen purchased inventory on December 1,2017.Payment of

Q35: Revenue Rulings carry the same legal force

Q55: By what methods can a person gain

Q58: Which of the following is not a

Q86: Assume the functional currency is the U.S.Dollar;compute

Q88: Section 721 provides that no gain or

Q88: Jonathon owns a one-third interest in a