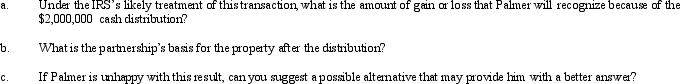

Palmer contributes property with a fair market value of $4,000,000 and an adjusted basis of $3,000,000 to AP Partnership.Palmer shares in $1,000,000 of partnership debt under the liability sharing rules,giving him an initial adjusted basis for his partnership interest of $4,000,000.One month after the contribution,Palmer receives a cash distribution from the partnership of $2,000,000.Palmer would not have contributed the property if the partnership had not contractually obligated itself to make the distribution.Assume Palmer's share of partnership liabilities will not change as a result of this distribution.

Definitions:

Career Path

A progression or sequence of jobs and roles that an individual may follow throughout their career, often featuring opportunities for advancement and development.

Employee Training

The process by which employees are provided with the necessary knowledge and skills to perform their current jobs effectively or to acquire capabilities for new roles.

Corporations

Legal entities that are separate and distinct from their owners, providing limited liability protection to its shareholders.

Annually

Pertaining to something that occurs once every year or relating to a period of one year.

Q6: The December 31,2012,balance sheet of the calendar-year

Q17: The lowering of tax rates will lead

Q20: Which of the following is not a

Q23: Prepare an income statement for this subsidiary

Q42: What journal entry should Eagle prepare

Q48: Aubrey has been operating his business as

Q50: Rex and Scott operate a law practice

Q55: Only 80% of the shareholders must consent

Q65: Ralph sells property to Sam who,by prearranged

Q145: An S shareholder's stock basis includes a