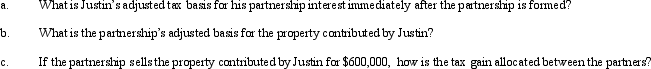

Greg and Justin are forming the GJ Partnership.Greg contributes $500,000 cash and Justin contributes nondepreciable property with an adjusted basis of $200,000 and a fair market value of $550,000.The property is subject to a $50,000 liability,which is also transferred into the partnership and is shared equally by the partners for basis purposes.Greg and Justin share in all partnership profits equally except for any precontribution gain,which must be allocated according to the statutory rules for built-in gain allocations.

Definitions:

Merchandise Inventory

Goods that a company owns and intends to sell as part of its regular business operations, usually in the retail sector.

Income Statement

A financial statement that shows a company’s revenues and expenses over a specific period, highlighting net profit or loss.

Merchandiser

A business entity engaged in selling goods directly to consumers or other businesses.

Cost Flow

The manner in which costs move through a firm, from initial acquisition of raw materials to final sale of finished goods.

Q13: A partnership cannot use the cash method

Q14: If a partnership allocates losses to the

Q20: Explain the function of Temporary Regulations.

Q20: Under the current rate method,how would cost

Q37: Which one of the following statements regarding

Q46: A company had common stock with a

Q74: A net liability balance sheet exposure exists

Q88: A U.S.company buys merchandise from a foreign

Q121: Estela,Inc. ,a calendar year S corporation,incurred the

Q131: Melinda's basis for her partnership interest is