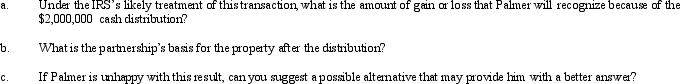

Palmer contributes property with a fair market value of $4,000,000 and an adjusted basis of $3,000,000 to AP Partnership.Palmer shares in $1,000,000 of partnership debt under the liability sharing rules,giving him an initial adjusted basis for his partnership interest of $4,000,000.One month after the contribution,Palmer receives a cash distribution from the partnership of $2,000,000.Palmer would not have contributed the property if the partnership had not contractually obligated itself to make the distribution.Assume Palmer's share of partnership liabilities will not change as a result of this distribution.

Definitions:

Population Variances

Population variances measure the variability or spread of a population's data points from its mean, indicating how much the population data values differ from each other.

Ratio

A measure that compares two quantities by division.

Difference

The quantitative discrepancy or deviation between two values or sets of data.

Two-tail Test

A statistical test that considers both the directions of a possible effect, testing for the possibility of positive or negative deviations from the null hypothesis.

Q2: A per-day,per-share allocation of flow-through S corporation

Q5: When a company has preferred stock in

Q5: What amount will Woolsey include as an

Q6: Milke,Inc. ,an S corporation,has gross receipts of

Q21: A foreign subsidiary of a U.S.corporation purchased

Q47: A § 754 election is made for

Q66: When preparing a consolidated statement of cash

Q69: Where is the translation adjustment reported in

Q86: A partnership may make an optional election

Q94: Assume Boerkian was a foreign subsidiary of