REFERENCE: 04-15

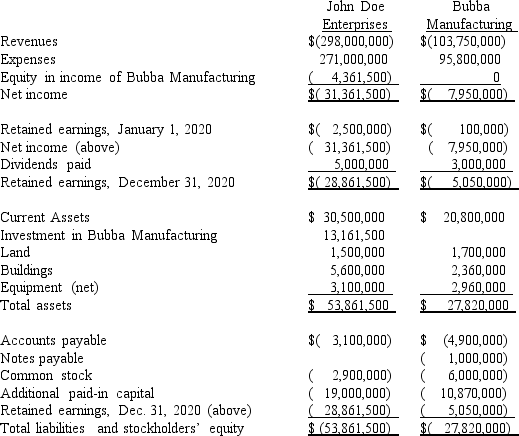

On January 1,2020,John Doe Enterprises (JDE)acquired a 55% interest in Bubba Manufacturing,Inc.(BMI).JDE paid for the transaction with $3 million cash and 500,000 shares of JDE common stock (par value $1.00 per share).At the time of the acquisition,BMI's book value was $16,970,000.

On January 1,JDE stock had a market value of $14.90 per share and there was no control premium in this transaction.Any consideration transferred over book value is assigned to goodwill.BMI had the following balances on January 1,2020.

For internal reporting purposes,JDE employed the equity method to account for this investment.

-The following account balances are for the year ending December 31,2020 for both companies.

Required:

Prepare a consolidation worksheet for this business combination.Assume goodwill has been reviewed and there is no goodwill impairment.

Definitions:

Capacity Flexibility

The ability of a production system to adjust its output in response to fluctuations in demand.

Part-Time Workforce

Employees who work less than the standard working hours, often offering businesses flexible labor options and workers a more adaptable schedule.

Peak Periods

Times of significantly higher demand or activity in a business cycle, often leading to increased stress on resources and operations.

Overtime

Extra hours worked beyond the normal full-time working hours, usually compensated at a higher pay rate.

Q2: Compute consolidated sales.<br>A)$10,000,000.<br>B)$10,126,000.<br>C)$10,140,000.<br>D)$10,200,000.<br>E)$10,260,000.

Q28: Assume that Boerkian was a foreign subsidiary

Q31: What are the three broad sections of

Q42: Simple City has recorded the purchase order

Q44: Pursley,Inc.owns 70 percent of Harry Corp.The

Q51: Prepare a schedule to calculate the safe

Q58: In comparing U.S.GAAP and International Financial Reporting

Q87: What is the basic objective of all

Q95: What is the balance in the investment

Q100: Compute the amortization of gain through a