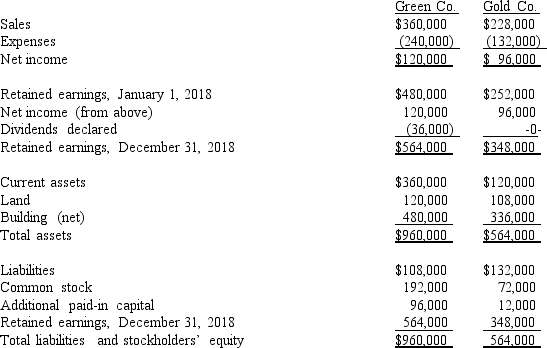

The following are preliminary financial statements for Green Co.and Gold Co.for the year ending December 31,2018 prior to Black's acquisition of Blue.

On December 31,2018 (subsequent to the preceding statements),Green exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Gold.Green's stock on that date has a fair value of $60 per share.Green was willing to issue 10,000 shares of stock because Gold's land was appraised at $204,000.Green also paid $14,000 to attorneys and accountants who assisted in creating this combination.

Required:

Assuming that these two companies retained their separate legal identities,prepare a consolidation worksheet as of December 31,2018 after the acquisition transaction is completed.

Definitions:

Federal Mediation

A process involving a neutral third party to facilitate negotiations and conflict resolution between groups, often in labor disputes.

Conciliation Service

A service that helps parties in a dispute to reach a voluntary agreement by acting as a mediator.

Independent Drivers Guild (IDG)

An organization that represents the interests of independent contractor drivers, particularly those connected with ride-sharing companies.

Wagner Act

A foundational piece of US labor legislation passed in 1935, formally known as the National Labor Relations Act, that protects the rights of employees to organize and to bargain collectively.

Q30: In a situation where the investor exercises

Q31: Finding the present value of the horizon

Q47: Jernigan Corp.had the following account balances

Q56: Special Revenue funds are<br>A)Funds used to account

Q58: What is the amount of consolidated net

Q62: In the consolidation worksheet for 2017,which of

Q81: The income reported by Dodge for 2017

Q82: What amount would Femur Co.report as consolidated

Q89: What should an entity evaluate when making

Q117: Which of the following internal record-keeping methods