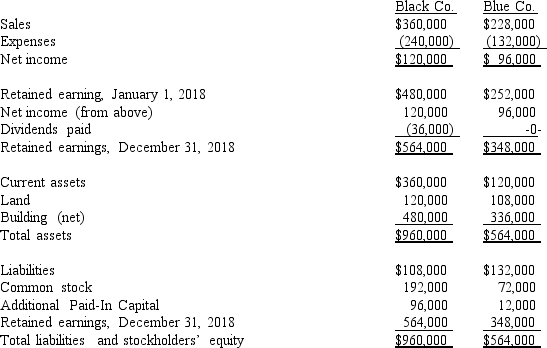

The following are preliminary financial statements for Black Co.and Blue Co.for the year ending December 31,2018,prior to Black's acquisition of Blue Co.

On December 31,2018 (subsequent to the preceding statements),Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue.Black's stock on that date has a fair value of $50 per share.Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000.Black also paid $14,000 to attorneys and accountants who assisted in creating this combination.

Required:

Assuming that these two companies retained their separate legal identities,prepare a consolidation worksheet as of December 31,2018.

Definitions:

Adjusting Entry

At the end of an accounting timeframe, records are made to attribute income and spending to the specific period in which they were incurred.

Accumulated Depreciation

The total sum of depreciation for a fixed asset that has been charged to expense since the asset was acquired and placed into service.

Book Value

The value of an asset as recorded on the balance sheet, calculated as the cost of the asset minus any accumulated depreciation.

Equipment Cost

The total amount spent on purchasing equipment, including the purchase price, taxes, shipping, and installation fees.

Q3: What is the Equity in Maya Income

Q6: At the end of 2017,the consolidation entry

Q17: A company has been using the equity

Q26: Which of the following is false regarding

Q34: On the consolidated financial statements for 2017,what

Q45: What is consolidated stockholders' equity at January

Q55: For what is a special revenue fund

Q60: Before liquidating any assets,the partners determined

Q88: Compute the noncontrolling interest in the net

Q95: What is the balance in the investment