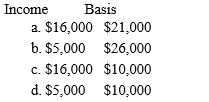

In the current year,Darlene purchases a 20% interest in the Grant Partnership (GP)for $10,000.During the current year,GP has a taxable income of $80,000 and Darlene withdraws $5,000 of cash from the partnership.Darlene's income to be reported from her investment in GP and her basis in GP at the end of the year is:

Definitions:

Innovation

The process of creating new methods, ideas, or products, or the introduction of something new that adds value.

Declining Industries Argument

The notion that certain sectors of the economy may experience a reduction in demand and productivity, leading to a downturn in those industries.

Foreign Competition

The competition that domestic companies face from companies located in other countries.

Dumping

The act of selling a product in a foreign market at a price below its cost of production or below the price in the home market, often considered unfair trade.

Q11: Todd and Fiona are negotiating a divorce

Q24: Chicago Cleaning Services provides nightly janitorial services

Q27: The ability-to-pay concept is fundamental to the

Q32: The information that follows applies to the

Q45: The discount rate applied in an Expected

Q61: Indicate the number of principles of entrepreneurial

Q62: How much additional Social Security tax does

Q81: During 2016,Myca sells her car for $5,000.She

Q97: All of the following are a required

Q118: Explain why the taxpayer in each of