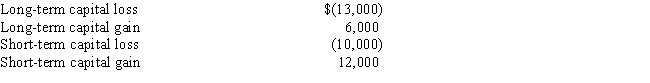

Benjamin has the following capital gains and losses for the current year:  What is Benjamin's net capital gain or loss for the year?

What is Benjamin's net capital gain or loss for the year?

Definitions:

Regressive Tax

A tax system that takes a smaller percentage of income from individuals as their income increases, often considered less fair to lower-income earners.

Payroll Taxes

Financial obligations required from both employers and employees, pegged to a fraction of the payroll expenses incurred by employers.

Federal Tax Revenues

The income received by the federal government from taxes and other sources used to fund public expenditures.

Excise Tax

An excise tax is a specific tax levied on the sale of certain goods and services, such as alcohol, tobacco, and fuel, usually with the aim of discouraging their use or raising government revenue.

Q27: Which of the following types of taxes

Q52: Which of the following is true regarding

Q64: Economic Performance<br>A)Specifically disallowed.<br>B)Appropriate and helpful.<br>C)Considered a trade

Q67: On her 18th birthday,Patti's grandfather gave her

Q69: Drew graduated from business school in December

Q83: Damage payments<br>A)Dues, uniforms, subscriptions.<br>B)Intended to punish and

Q99: Which of the following interest-free loans is

Q115: Under the all-inclusive income concept,the tax law

Q121: Tyrone sells his personal-use car that had

Q137: Constructive Receipt Doctrine<br>A)Income is subject to tax