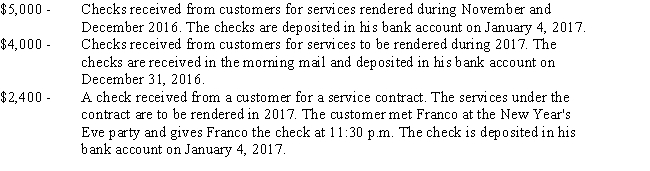

Franco is owner and operator of a cleaning service who uses the accrual method of accounting.He receives the following payments on December 31,2016,the last business day of his tax year:

How much of the $11,400 collected by Franco on December 31 must be included in his 2016 gross income?

Definitions:

Appendix

A supplementary material at the end of a book, document, or presentation that provides additional details or explanations.

Pharyngeal Tonsils

Two masses of lymphatic tissue located above the palatine tonsils; also called adenoids.

Nasopharynx

The portion of the pharynx behind the nasal cavity.

Palatine Tonsils

Two masses of lymphatic tissue located at the back of the throat.

Q16: Susan purchased a lot for investment purposes.She

Q40: Hector is a 54-year-old head of household

Q72: Free cash exists when cash exceeds that

Q82: Janine,a cash-basis taxpayer,borrowed $15,000 for her business

Q92: Rayburn is the sole owner of a

Q96: Art has worked for Denver's Diamond Dealers

Q118: Patrick ran up a large credit card

Q134: Sanford's employer has a qualified pension plan

Q134: Karen owns a vacation home in Door

Q160: Sigma Company provides its employees with $25,000