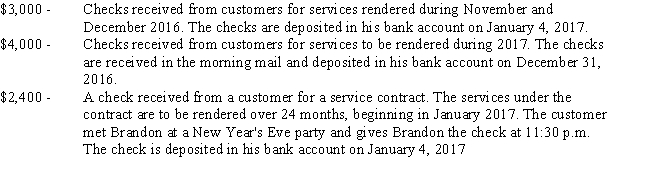

Brandon is the operator and owner of a cleaning service who uses the cash method of accounting.He receives the following payments on December 31,2016,the last business day of his tax year:

How much of the $9,400 collected by Brandon on December 31 must be included in his 2016 gross income?

Definitions:

Biological Variation

Differences among individuals and populations in physical, physiological, and genetic characteristics due to evolutionary, environmental, and genetic factors.

Creationism

The belief that the universe and living organisms originate from specific acts of divine creation, as in the biblical account, rather than by natural processes such as evolution.

Evolution

The mechanism through which a range of life forms are considered to have emerged and branched out from previous versions during Earth's historical timeline.

Punctuated Equilibrium

A theory in evolutionary biology which proposes that species evolve rapidly in short bursts, followed by long periods of evolutionary stasis.

Q8: Dreamland Corporation purchased 10,000 shares of Sleepytime,Inc.common

Q24: During the current year,Paul came down with

Q59: Mixed-use asset<br>A)Automobile used 75% for business.<br>B)Investment expenses

Q68: The income tax treatment of payments from

Q73: A crucial question concerning income is when

Q89: Rodrigo works as a salesperson for a

Q104: The Federal income tax is a<br>A)revenue neutral

Q126: Under the deferral method of accounting for

Q135: John purchased State of Oklahoma general-purpose bonds

Q158: Employer-provided lodging<br>A)Dues, uniforms, subscriptions.<br>B)Intended to punish and