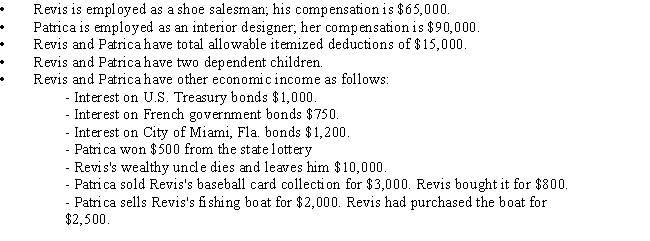

The information that follows applies to the current year for Revis and Patrica,a married couple.  Based on the above information,what is Revis and Patrica 's taxable income?

Based on the above information,what is Revis and Patrica 's taxable income?

Definitions:

Childhood Experiences

Events and interactions during early years of life that significantly influence one's development and personality.

Fully Functioning Person

A term by Carl Rogers describing an individual who is in touch with their feelings and desires, living a life that is authentic and fulfilling.

Mental

Related to the processes of the mind or psychological states and functions.

Physical

Pertaining to the body as opposed to the mind or spirit, involving biological and physiological attributes or activities.

Q31: Julia spends her summers away from college

Q33: Employee discount<br>A)Dues, uniforms, subscriptions.<br>B)Intended to punish and

Q35: Which of the following information is not

Q58: Joan purchased her residence in 2010 for

Q66: Flexible benefits plan<br>A)An employee may exclude up

Q77: Andrea has the following capital gains and

Q80: Taxable entity<br>A)Allocates income, losses, and deductions to

Q83: Travis is a 30% owner of 3

Q86: Meredith,age 14,earns wages of $2,100 from her

Q143: Kadian purchases a block of 10 tickets