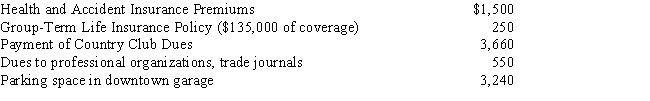

Summary Problem: Ralph,age 44,is an account executive for Cobb Advertising,Inc.Ralph's annual salary is $90,000.Other benefits paid by Cobb Advertising were:

In addition to the benefits above,Cobb Advertising has a qualified pension plan into which employees can contribute (and Cobb matches)up to 5% of their annual salary.Ralph contributes the maximum allowable to the plan.

Ralph has never been able to itemize his allowable personal deductions (i.e.,he always uses the standard deduction).In 2016,Ralph receives a refund of $300 of his 2015 State income taxes and a 2015 Federal tax refund of $400.

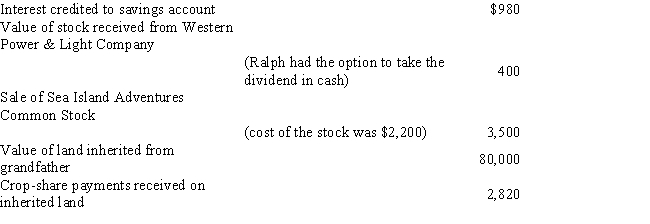

Other sources of income:

Required: Compute Ralph's 2016 gross income.

Definitions:

Psoas Minor

The psoas minor is a slender muscle that runs along the psoas major, involved in flexing the lumbar region of the vertebral column.

Vertebral Column

The stack of vertebrae extending from the skull to the lower back, surrounding and protecting the spinal cord.

Abdominal Muscles

A group of muscles in the abdomen that includes the rectus abdominis, transversus abdominis, and the internal and external obliques, providing support to the core.

Intercostals

Muscles located between the ribs that assist with the breathing process by facilitating the expansion and contraction of the chest cavity.

Q8: How much gross income does Faith have

Q17: Marlene is a single taxpayer with an

Q23: Arlene,a criminal defense attorney inherits $500,000 from

Q39: Active Trader<br>A)Specifically disallowed.<br>B)Appropriate and helpful.<br>C)Considered a trade

Q71: At-risk amount<br>A)A loss that is generally not

Q80: Drew incurs the following expenses in his

Q92: Jay obtains a new job in Boston

Q109: For any unrecovered portion of an annuity

Q127: Which of the following never generate taxable

Q157: To qualify as a head of household,an