Wilson owns a condominium in Gatlinburg,Tennessee.During the current year,she incurs the following expenses before allocation related to the property:

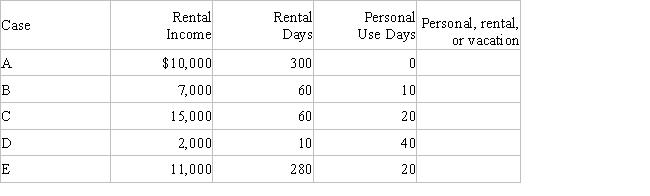

a.For each of the following scenarios indicate whether Wilson would treat the condominium for income tax purposes as personal use property, a rental or a vacation home.

b.Consider Case C. Determine Wilson's deductions related to the condominium. Indicate the amount of each expense that can be deducted and how it would be deducted.

Definitions:

Sarcophagi

Stone coffins, typically adorned with sculptures and inscriptions, used primarily in ancient civilizations for the burial of the dead.

Haniwa

Sculpted fired pottery cylinders, modeled in human, animal, or other forms and placed on Japanese tumuli of the Kofun period.

Kamakura Period

A period in Japanese history (1185-1333) marked by the rule of the Kamakura shogunate, notable for its significant cultural and artistic developments, especially in Buddhist art.

Yayoi

A period in Japanese history (around 300 BCE to 300 CE) characterized by the introduction of agriculture, metalworking, and new pottery styles from the Asian continent.

Q13: Which of the following losses are generally

Q36: Steve is an employee of Giant Valley

Q49: George is a full-time student at Indiana

Q90: The split basis rules for business property

Q91: Lillian and Michael were divorced last year.Michael

Q93: During the current year,Hope Corporation paid a

Q100: A passive activity<br>I.includes any trade or business

Q126: Marline receives $14 million in punitive damages

Q139: Melvin was in an accident which was

Q150: Southview Construction Company enters into a contract