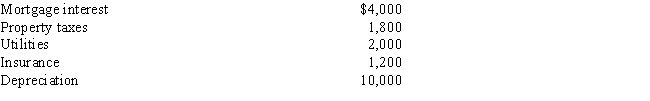

Cornelius owns a condominium in Orlando.During the year,Cornelius uses the condo a total of 25 days.The condo is also rented to vacationers for a total of 75 days and generates rental income of $9,000.Cornelius incurs the following expenses:

Determine Cornelius's deduction related to the condominium.Indicate the amount of each expense that can be deducted and how it would be deducted.

Definitions:

Managerial Skills

The capabilities and knowledge necessary for effective planning, organizing, directing, and controlling of an organization’s resources to achieve its objectives.

Organizational Hierarchy

A structured arrangement of jobs and departments within an organization, ranked according to levels of responsibility, authority, and status.

Leadership Process

The ongoing practice of influencing and guiding others towards achieving collective goals.

Leadership Skills

The ability to influence and guide individuals or groups towards the achievement of goals.

Q32: Gloria owns 750 shares of the Greene

Q51: Walter pays a financial adviser $2,100 to

Q52: Larry and Louise are both 49 years

Q66: Flexible benefits plan<br>A)An employee may exclude up

Q127: Brees Co.requires its employees to adequately account

Q132: Mr.and Mrs.Bachman,both age 65,file a joint return.In

Q133: Deductions for adjusted gross income include<br>I.Contribution to

Q136: Walker,an employee of Lakeview Corporation,drives his automobile

Q141: Philip has been working in Spain for

Q148: In addition to the regular standard deduction