Wilson owns a condominium in Gatlinburg,Tennessee.During the current year,she incurs the following expenses before allocation related to the property:

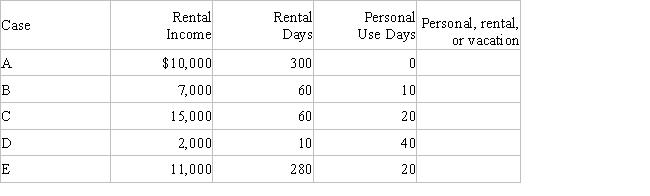

a.For each of the following scenarios indicate whether Wilson would treat the condominium for income tax purposes as personal use property, a rental or a vacation home.

b.Consider Case C. Determine Wilson's deductions related to the condominium. Indicate the amount of each expense that can be deducted and how it would be deducted.

Definitions:

Operating Profit

Profit earned from a firm's core business operations, excluding deductions of interest and tax.

Potted Poinsettias

A common household plant, particularly popular during the holiday season, characterized by its red and green foliage.

Operating Profit

A company's profit from its regular business operations, excluding expenses from interest, taxes, and other non-operational activities.

Operating Profit

Operating profit is the income earned from a company's core business operations, excluding deductions of interest and taxes.

Q11: Todd and Fiona are negotiating a divorce

Q23: Arlene,a criminal defense attorney inherits $500,000 from

Q37: A transaction loss occurs when an asset

Q75: Home equity loan interest<br>A)Prepaid interest.<br>B)An amount that

Q85: List the criteria necessary for an expenditure

Q93: During the current year,Hope Corporation paid a

Q101: Chipper borrowed money from several creditors for

Q111: Linda's personal records for the current year

Q114: Anna receives a salary of $42,000 during

Q146: Victor receives a $4,000 per year scholarship