During 2016,Marsha,an employee of G&H CPA firm,drove her car 24,000 miles.The detail of the mileage is as follows:

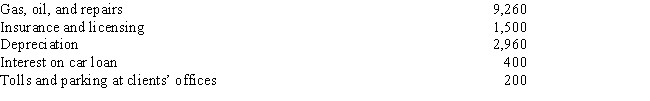

Marsha's 2016 records show that her car expenses totaled $14,320.The details of the expenses are as follows:

What is the amount of her deduction for her use of the car?

Definitions:

Civil Rights Movement

A struggle for social justice in the 1950s and 1960s in the United States aimed at ending racial discrimination and gaining equal rights under the law.

Anti-war Movement

Social movements, typically during periods of military conflict, that advocate for peace and are against the initiation or continuation of armed conflict.

Vietnam War

A prolonged conflict (1955-1975) between communist forces in North Vietnam, supported by its allies, and the government of South Vietnam, backed by the United States.

President Kennedy

John F. Kennedy, the 35th President of the United States, served from January 1961 until his assassination in November 1963.

Q6: The term tax shelter refers to investment

Q11: Melonie purchased 100 shares of Wake Corporation

Q34: Which of the following individuals is involved

Q52: Larry and Louise are both 49 years

Q61: Sadie is a full time nurse and

Q61: Lu-Yin purchased her consulting business with $75,000

Q93: Reiko buys 200 shares of Saratoga Corporation

Q129: Describe the rules that apply to individual

Q133: Jerry's wife dies in September.His wife had

Q142: Devery,Inc.sells high tech machine parts that are