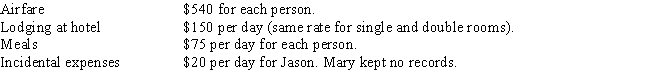

Jason travels to Miami to meet with a client.While in Miami,he spends 2 days meeting with his client and 3 days sightseeing.Mary,his wife,goes with him and spends all 5 days sightseeing and shopping.The cost of the trip is as follows:

If Jason is self-employed,what is the amount of the deduction he may claim for the trip?

Definitions:

Prepaid Expenses

Payments made for goods or services to be received in the future, recognized as assets on the balance sheet until they are incurred.

Journal Entry

A record of financial transactions in the accounting books of a business, indicating the accounts affected and the amounts.

Credits

Refers to the accounting entries that increase liabilities or decrease assets, representing the opposite effect of debits in double-entry bookkeeping.

Liability Accounts

Accounts on a balance sheet that represent obligations or debts that a company owes to others, which must be settled over time through the transfer of economic benefits including money, goods, or services.

Q4: Kim owns a truck that cost $35,000

Q15: Mary pays $25,000 and secures a mortgage

Q40: Hector is a 54-year-old head of household

Q45: Determine the adjusted basis of the following

Q48: Children under 18 and full time students

Q53: As a result of their divorce this

Q101: Sita loans her next-door neighbor,Ivan,$800 to pay

Q117: Byron loaned $5,000 to his friend Alan

Q141: Non-deductible expense<br>A)Automobile used 75% for business.<br>B)Investment expenses

Q152: Samuel slips on an icy spot in