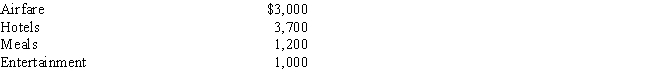

Joline works as a sales manager for the Washington Manufacturing Company.Although the company has an accountable reimbursement plan,as a cost containment measure the company will only reimburse its sales personnel for 80% of their business expenses.During the year,Joline incurred the following business expenses:

If Joline's adjusted gross income is $62,000,what amount can Joline deduct as a miscellaneous itemized deduction?

Definitions:

Strike Price

A term synonymously used with Exercise Price, indicating the fixed price at which an option holder can buy or sell the underlying asset.

Contract Maturity

The predetermined date on which a financial contract, such as a bond or a futures contract, expires or is settled.

Stock Price

The monetary value at which a company’s stock is traded on the market, influenced by factors like company performance and market conditions.

Premium

The amount by which the price of a bond or other security exceeds its principal amount or face value.

Q27: Passive activity<br>A)Limited to $3,000 annually for individuals.<br>B)When

Q27: Jolie purchased her residence in 2010 for

Q32: The information that follows applies to the

Q40: Imputed income<br>A)The category of income that includes

Q69: Ernest went to Boston to negotiate several

Q71: On July 3,2016,Cynthia receives a gift of

Q101: Given below are Mario's capital gains and

Q106: To keep the employees on the premises

Q135: Property settlement<br>A)The category of income that includes

Q141: Bonita's employer has a nondiscriminatory childcare reimbursement