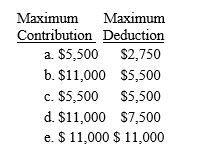

Marshall and Michelle are married with salaries of $80,000 and $64,000,respectively.Their combined AGI is $184,000.Michelle is an active participant in her company's qualified pension plan while Marshall is not.Determine the maximum combined IRA contribution and deduction amounts?

Contribution Deduction

Definitions:

Expected Return

The weighted average of all possible returns from an investment, accounting for the likelihood of each outcome.

Standard Deviation

Standard Deviation measures the amount of variation or dispersion from the average, indicating the risk associated with a variable.

Treasury Bills

Short-term government securities issued at a discount from the face value and maturing at par, typically within a year.

Beta

A measure of a stock's volatility in relation to the overall market, indicating the stock's risk compared to that of the average market risk.

Q1: Legal expenses are generally deductible if they

Q2: Limited partnership<br>A)A loss that is generally not

Q19: When a stock dividend is nontaxable,part of

Q23: If an individual is not a material

Q31: Smokey purchases undeveloped land in 1999 for

Q76: Barry owns all of the stock of

Q84: Ted purchases some forest land in 2014

Q111: The income tax concept that is primarily

Q114: Anna receives a salary of $42,000 during

Q118: Generally income tax accounting methods are designed