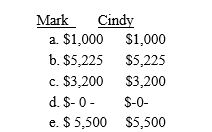

Mark and Cindy are married with salaries of $45,000 and $42,000,respectively.Adjusted gross income on their jointly filed tax return is $98,000.Both individuals are active participants in employer provided qualified pension plans.What is the maximum amount each person may deduct for AGI with regard to IRA contributions?

Definitions:

Fear Of Strangers

an anxiety disorder characterized by an intense fear or apprehension when one is around or anticipates interaction with strangers.

Separation Anxiety

Emotional distress seen in individuals, especially children, due to being separated from familiar people or environments.

Distress

A negative emotional state caused by stress, characterized by feelings of anxiety, sorrow, or pain.

Separation Anxiety

a disorder characterized by excessive anxiety regarding separation from home or from those to whom the individual has a strong emotional attachment.

Q31: Julia spends her summers away from college

Q56: Janine is an engineering professor at Southern

Q58: Business meals<br>A)Not deductible.<br>B)Short-term capital loss.<br>C)Limited to $25

Q59: Perry inherits stock from his Aunt Margaret

Q63: Mavis is injured in an automobile accident

Q67: Portfolio income consists of unearned income from

Q122: For each of the following situations,determine the

Q148: In addition to the regular standard deduction

Q151: Generally income tax accounting methods are designed

Q155: Gross income test<br>A)Prepaid interest.<br>B)An amount that each