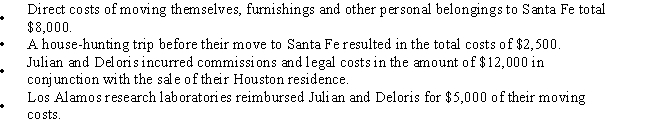

Julian and Deloris move during the current year from their home in Houston to Santa Fe.Julian was a rocket scientist with NASA in Houston and has accepted a new job with the Los Alamos research lab near Santa Fe.Moving expenses and reimbursement information are presented below.  What is their Moving Expense deduction?

What is their Moving Expense deduction?

Definitions:

Purely Competitive

A market structure characterized by many small firms producing an identical product, where no single firm can influence the market price.

Wage Rate

The fixed amount of compensation paid to an employee by an employer in exchange for work performed, typically expressed per hour or year.

Purely Competitive

A market situation characterized by a large number of small firms, no barriers to entry or exit, homogenous products, and perfect information among buyers and sellers, leading to the efficient allocation of resources.

Q12: Associated with<br>A)Not deductible.<br>B)Short-term capital loss.<br>C)Limited to $25

Q22: Twin City Manufacturing Corporation is an accrual

Q40: Baylen,whose adjusted gross income is $60,000,purchases a

Q48: Penny owns her own business and drives

Q70: Active participant<br>A)A loss that is generally not

Q79: On June 10,2015,Wilhelm receives a gift of

Q85: Which of the following events is a

Q89: Recourse debt<br>A)A loss that is generally not

Q105: Which of the following statements is/are correct?<br>I.Belle

Q126: Marline receives $14 million in punitive damages